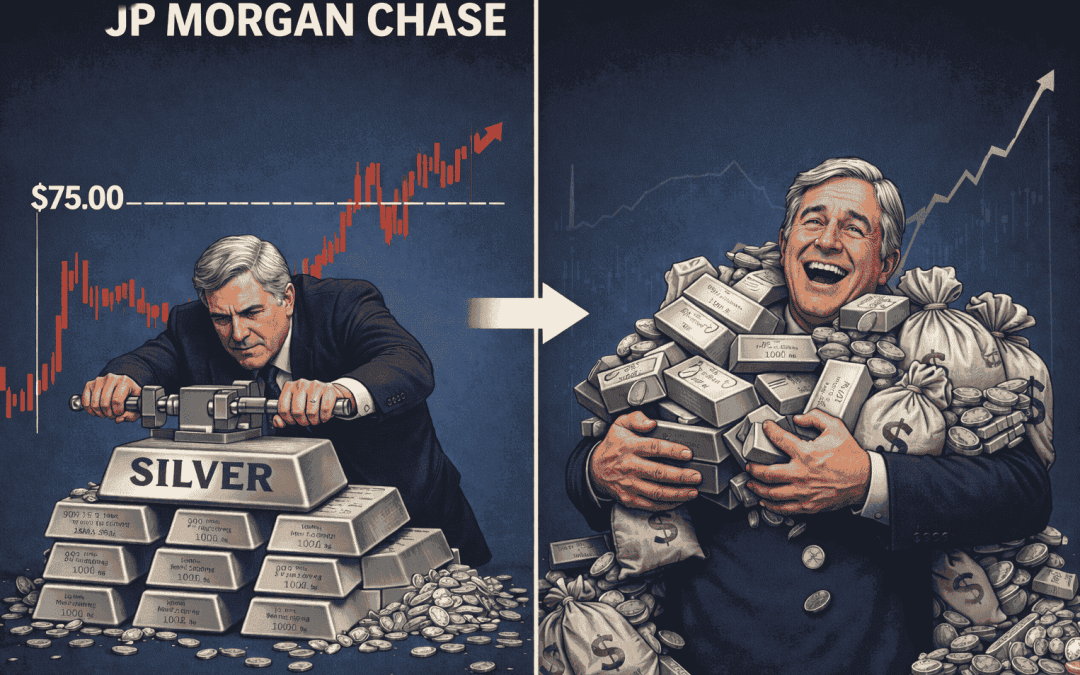

In a historic strategic reversal, JPMorgan Chase has completely closed its notorious 200-million-ounce “naked” short position, which for over a decade was accused of suppressing silver prices through paper derivatives, and pivoted to amassing a massive physical stockpile of over 750 million ounces. By late 2025, the bank had leveraged its dominant position as a COMEX custodian to hoard the equivalent of nearly a full year’s global mine production, fueling a price surge from $31 to $62 per ounce. This shift from price suppressor to physical accumulator, executed amid a landscape of regulatory fines and market concentration, has led analysts to raise 2026 price targets to as high as $105, as the bank’s long game finally aligns with a tightening physical market. The Silver market has changed forever.

Swapping Sides

The z executed by JPMorgan Chase in late 2025 represents one of the most significant shifts in the history of the precious metals markets. By transitioning from a decades-long role as the market’s primary price suppressor to its most aggressive physical accumulator, the bank has fundamentally altered the mechanics of silver price discovery.

The Great Unwind and the Peer Squeeze

Beginning in June 2025, JPMorgan initiated a methodical exit from its massive paper short positions, which had long been the target of market manipulation allegations. As market fundamentals tightened due to record industrial demand, the bank reportedly “cut bait” on its historical practice of leasing silver to peer institutions. By withdrawing these silver loans, JPMorgan effectively pulled the liquidity rug out from under competitors like HSBC and UBS. These banks were forced into the open market to repurchase silver at rapidly escalating prices to cover their own obligations. This maneuver not only protected JPMorgan from the rising tide of silver prices but actively funneled billions in “squeeze profits” back into its coffers as its peers scrambled to cover their losses.

The Six-Week Hoard and the Triple Play

The speed of JPMorgan’s accumulation has been unprecedented. In a mere six-week window during the fourth quarter of 2025, the firm added a staggering 21 million ounces to its COMEX and ETF-custodied holdings. This aggressive stockpiling serves a calculated triple play strategy:

- Supply Control: By locking up physical metal in “Eligible” (non-deliverable) categories, the bank has created a bottleneck in the available supply.

- Price Appreciation: As the largest holder, JPMorgan stands to gain the most from the silver rally, which saw prices climb from $31 to over $75 by year-end.

- The Ultimate Squeeze: With control over the physical metal, the bank can effectively “corner” remaining short sellers, forcing a parabolic move as paper contracts fail to find physical settlement.

Why The Pivot?

A perfect storm of economic forces compelled JPMorgan’s radical pivot in late 2025, driven primarily by an undeniable structural breakdown in the silver market. At the heart of this shift is a massive deficit where global mine output, stagnant at approximately 813 million ounces, has proven utterly incapable of satisfying the record-breaking 1.2 billion ounces required by the technology and green energy sectors. This relentless industrial demand from solar photovoltaics, electric vehicles, and AI infrastructure created a supply gap of nearly 200 million ounces in 2025 alone, marking the fifth consecutive year of significant market shortfalls.

The mechanical cracks in the global trading system became visible in October 2025, as a severe “physical delivery crisis” took hold. During this period, silver lease rates in major hubs like London and New York spiked to extraordinary levels, briefly touching 24%, a frantic signal that physical bars were simply not available for immediate delivery. This physical tightness was mirrored on the COMEX, where paper claims reached a staggering ratio of 2.5 to 1 against registered physical stocks, suggesting that the “paper” price had become completely decoupled from the reality of the vault.

Broader macro-economic pressures further accelerated JPMorgan’s decision to exit its historical short positions. As the Federal Reserve returned to a regime of quantitative easing and interest rate cuts to combat systemic volatility, silver’s appeal as a monetary hedge reached a fever pitch. This was compounded by an official silver coin shortage declaration from the U.S. Mint and looming export restrictions from China, which traditionally supplies a massive portion of the world’s refined silver. For JPMorgan, this was no longer a matter of simple trading; it was a pivot toward survival. By amassing a dominant physical hoard, the bank successfully insulated its own balance sheet against a potential systemic collapse, effectively turning its back on its Wall Street peers to protect itself from the very instability it once helped manage.

Is Silver Now Bullish?

The most profound implication of this shift is the removal of JPMorgan’s long-standing downward pressure, a move that many believe could finally unleash silver’s true market value. As of January 6, 2026, the white metal is already in the midst of a historic breakout, with spot prices surging to $78.00 per ounce, marking a staggering 159% increase compared to this time last year. This rally represents more than just volatility, it reflects a fundamental upward bias as the market prices in a persistent, multi-year structural deficit.

Shattering Forecasts

The reality of 2025 has completely shattered institutional projections. While JPMorgan’s early 2025 forecasts conservatively pegged silver at an average of $36, the metal has consistently defied gravity. By late 2025, silver broke its previous 45-year nominal high of $54.42, and today’s price of $78 confirms that the market has entered a period of true price discovery.

Future Outlook – From Bullish to Parabolic

Looking ahead into 2026, analysts have been forced to rapidly revise their targets. The consensus is that most major banks now cluster their 2026 forecasts between $65 and $88, citing a fifth consecutive year of supply shortages and relentless industrial demand from the AI and solar sectors.

The triple digit specialists are telling us something else. High-conviction analysts, such as those at CNBC and veterans like Michael Oliver, now openly target $100 to $150 per ounce, viewing the current breakout as a gamma squeeze where short sellers are forced to cover in a vacuum of physical supply.

The Bold Extremes are even more bold in their claims. Comparisons to the 1980 Hunt Brothers squeeze, when adjusted for 2026 inflation, suggest that if a total physical supply crunch materializes, prices could theoretically push toward $600. However, unlike the Hunts who were undone by paper leverage and regulatory changes, JPMorgan’s current focus on physical bars provides them with unprecedented control and immunity to margin calls.

Market Impact

The transition to this New Silver Era will be felt across two fronts:

- Industrial Stress: Manufacturers in the EV, 5G, and solar industries may face a period of rationing and high premiums, as they compete with a “predator” bank that now controls the choke point of supply.

- Investor Opportunity: For retail and institutional investors, the “JPMorgan pivot” signals the twilight of a decades-long suppression regime. As the bank shifts its trading operations toward Singapore to capture burgeoning Asian demand, silver is being repositioned as a cornerstone asset for monetary resilience in an era of de-dollarization and sticky inflation.

- As JPMorgan places its multibillion-dollar bet on the white metal, the global market is watching closely. This isn’t just a trade; it is the long-awaited Silver Renaissance, signaling a move away from paper-based price discovery toward a reality governed by physical scarcity.

Thank you.