In trading, confidence often comes from repetition and clarity. When we understand not just what our strategies do but how they perform across different asset classes and market conditions, we gain the conviction to follow through with discipline. That’s why accurate back testing is a cornerstone of successful system development, and why we’ve built a powerful new back testing tool for ASR – and soon, BASZ, for Pipnotic users.

Reliable Back Testing

Back testing isn’t just a technical formality, it’s a lens into the past to better see what may happen in the future. As the saying goes, history doesn’t repeat, it rhymes. When done well, it gives traders a valuable insight into crucial performance metrics like returns, drawdowns, risk exposure, and overall robustness. But not all back tests are created equal. A flawed model can paint a deceptively rosy picture, luring traders into false confidence and preventable losses. This is why we built a back testing tool for the ASR and BASZ algorithms, so users are able to find instruments and timeframes that are profitable.

Real or Synthetic Data

Traders often face a trade-off between speed and realism. Historical data provides authenticity but can be sparse or expensive; synthetic data offers flexibility but may lack real-world complexity. Our back tester lets you choose either route.

Use real historical market data to evaluate how your strategy behaves under authentic, real-world conditions – whether it’s navigating sharp spikes in volatility, enduring periods of flat, trendless stagnation, or adapting to unexpected market shocks. This allows you to observe how a system would have performed in the past, offering crucial insights into potential strengths and weaknesses.

Alternatively, you can generate synthetic data, as used in our Trade Simulator, that mirrors the statistical characteristics of real markets – such as volatility clustering, Brownian motion, trending phases, mean reversion, and noise. This lets you design and stress-test your strategy against rare or extreme market events that may not appear in historical data but could easily happen in the future.

Together, these tools give you a controlled environment to experiment, iterate, and refine your ideas, helping you gain confidence and clarity before risking capital in live trading.

Precision Matters

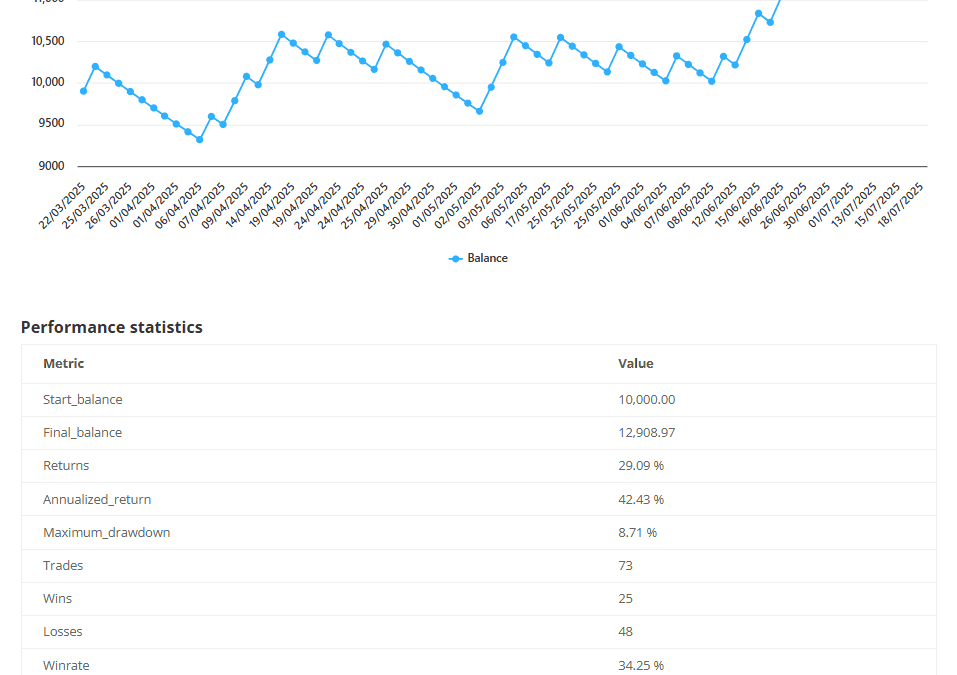

Writing the back testing utility was actually more difficult than I thought it would be. Obviously, I knew it wasn’t going to be a walk in the park, but I was surprised by the importance of managing open trades and registering winning and losing trades accurately. Each position is carefully logged, which took a few iterations to get right, and every trade includes full lifecycle tracking (entry, exit, size, reason), and every fee is accounted for as well, which is configurable via the input parameters. Stop losses and take profits are evaluated logically – with strict prioritization to reflect real market behaviour. The simulation doesn’t simply assume trades are filled. It checks bar-by-bar whether a stop would realistically have been hit before a target, and vice versa. It all seems to work rather well, and here is a screenshot displaying the results of a back testing iteration using synthetic data:

The results of each back testing iteration are carefully displayed and the data, trades and statistics are all available for download after each run.

Statistics That Go Beyond Win Rate

Performance metrics go far beyond the basics. You’ll get a detailed breakdown of:

- Annualized returns

- Maximum drawdown

- Win/loss ratio

- Profit factor

- Sharpe ratio

- Calmar ratio

- Risk-reward (R) profile

- Win/loss streaks

These aren’t just numbers. They are decision-making tools that help you answer essential questions like: How consistent is my strategy? How well does it handle risk? What happens during losing streaks, and is it able to recover?

A Strategy Rooted Deviation and Volatility

The current algorithm used in the back tester, which is currently limited to Asset Strength Reversion (ASR), uses a mean deviation approach, incorporating both price and volatility-based qualification rules. It evaluates entry opportunities when prices diverge significantly from the norm, and confirms whether the volatility context supports action, based on what it has seen historically in outlier data. This dynamic filtering mechanism ensures trades only trigger under qualifying conditions, improving quality over quantity.

Transparency, Flexibility, and Control

Every simulation run starts with clear inputs: capital, risk per trade, stop and target multipliers, mean and volatility periods, and more. You can test short bursts of intense market action or simulate full years of hourly data. Whether you want to see how a strategy behaves during a crash, or how it compounds during periods of low noise, you’re in control. Here’s a screenshot of the user interface where users are able to manipulate back testing iterations:

You can even view the full log of trades and balances, inspect floating P&L, and experiment with different thresholds and filters.

Conclusion

Accurate back testing is the cornerstone of developing robust and reliable trading strategies. By leveraging real historical market data and advanced synthetic data generation, traders can rigorously evaluate strategy behaviour across a wide spectrum of market conditions, from volatile spikes to prolonged stagnation, and prepare for rare, extreme scenarios that might otherwise catch them off guard.

Building on this foundation, we are now advancing towards a powerful split architecture that combines a deep learning back-end in python, with a sleek, web-based front end and API, in PHP. This design enables intensive model training and complex analysis to happen behind the scenes, while providing users with an intuitive interface to efficiently filter and monitor trades based on key metrics such as the Asset Strength Reversion (ASR) and the Buy and Sell Zones (BASZ).

This architecture not only enhances the speed and scalability of the back testing and signal filtering process but also empowers traders to make smarter, data-driven decisions in real time. Together, these innovations are setting a new standard for algorithmic trading tools, bridging cutting-edge AI capabilities with practical usability to help traders confidently navigate today’s dynamic markets.

If you have not yet seen or used the strategies tester, please visit the following link.

Thank you.